by Dan Mitchell

Last week, I gave a presentation on the Laffer Curve to a seminar organized by the New Economic School in the nation of Georgia.

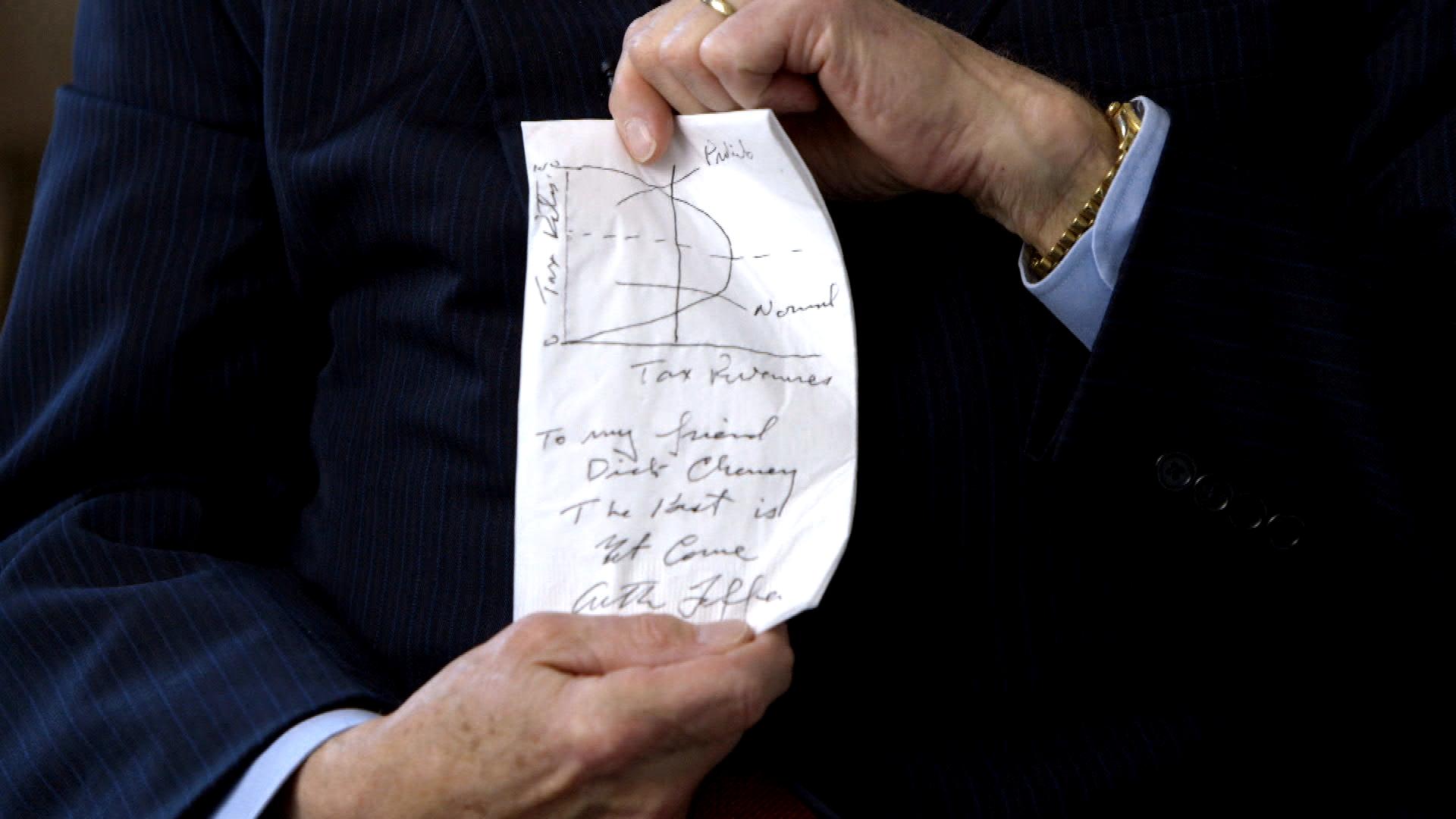

A major goal was to help students understand that you can’t figure out how changes in tax rates affect tax revenues without also figuring out how changes in tax rates affect taxable income.

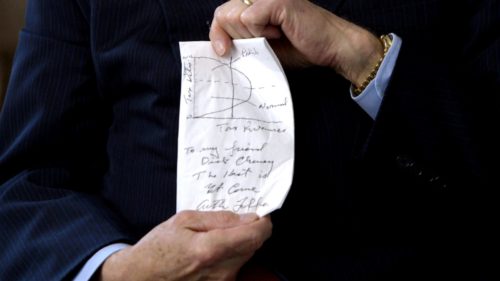

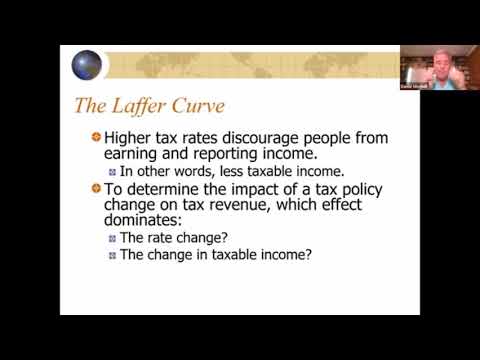

As you might expect, I showed the students a visual depiction of the Laffer Curve, explaining that the government won’t collect any revenue if the tax rate is zero (the left point of the horizontal axis), but also pointing out that the government won’t collect any revenue if tax rates are 100 percent(the right point on the horizontal axis).

The curve between those two points shows how much tax is collected at various tax rates.

The upward-sloping part of the curve shows the “region of increasing revenue” (i.e., where higher tax rates produce more revenue) and the downward-sloping part of the curve shows the “region of declining revenue” (i.e., where higher tax rates produce less revenue).

I noted in my remarks that this is not a controversial concept.

Indeed, I’d wager that every economist in the world will agree.

Just in case you think I’m exaggerating, you can see in this video that even Paul Krugman agrees that there is a Laffer Curve.

Needless to say, this doesn’t mean that we agree on the shape of the Laffer Curve.

Even more important, we presumably don’t agree on the ideal point on the Laffer Curve.

I’m guessing he would want to be at the revenue-maximizing point, whereas I explained in the presentation that it’s much better to at the growth-maximizing point.

To show why this is an important distinction, I specifically cited research from two economists (one from the University of Chicago and one from the Federal Reserve) in hopes of getting students to understand that higher tax rates will destroy a lot of private income for every dollar of additional revenue that politicians will collect.

If you look at the nearby image, you’ll see that’s especially true for taxes on “capital” since households have much more control over the timing, level, and composition of business and investment income.

Maybe I’m just a wild-eyed libertarian, but I don’t think it’s a good idea to destroy lots of private income just so politicians get a bit of extra revenue to spend.

This does not mean, by the way, that the Laffer Curve is a panacea, or some sort of free lunch.

I should have shown the students this one-minute video clip of me pointing out that it’s only in rare circumstances that a tax cut generates enough additional growth (and therefore enough additional taxable income) to be self-financing.

To be sure, self-financing tax cuts do exist.

In the presentation, I shared the IRS data showing that the federal government collected fives times as much money from the rich after President Reagan reduced the top tax rate from 70 percent to 28 percent.

And I also shared the OECD data showing that industrialized nations are collecting more revenue from income taxes today, as a share of economic output, than they were back in 1980 when top tax rates on personal and corporate income were much higher.

And I also could have cited interesting results from Canada, Denmark, Hungary, Ireland, Italy, Portugal, Russia, France, and the United Kingdom.

I’ll close by recycling my three-part video series from 2008 on the Laffer Curve (assuming you’re not already tired of my voice after the 22-minute presentation at the start of today’s column).

The first video discusses the theory.

The second video looks at the evidence.

And the third video shines a spotlight on the Joint Committee on Taxation’s primitive methodology for producing revenue estimates.

The good news is that the Joint Committee on Taxation has been dragged kicking and screaming in the right direction since 2008, so the present process for estimating the revenue impact of change in tax policy is somewhat more accurate.

P.S. Here’s my response to Matt Yglesias’ supposed debunking of the Laffer Curve.

P.P.S. I used to think my friends on the left could be persuaded since they presumably don’t want tax rates to be so high that revenues decline. But it seems many of themactually are motivated by a desire to punish success rather than a desire to maximize revenue for government.

Daniel J. Mitchell is a public policy economist in Washington. He’s been a Senior Fellow at the Cato Institute, a Senior Fellow at the Heritage Foundation, an economist for Senator Bob Packwood and the Senate Finance Committee, and a Director of Tax and Budget Policy at Citizens for a Sound Economy. His articles can be found in such publications as the Wall Street Journal, New York Times, Investor’s Business Daily, and Washington Times. Mitchell holds bachelor’s and master’s degrees in economics from the University of Georgia and a Ph.D. in economics from George Mason University. Original article can be viewed here.

Self-Reliance Central publishes a variety of perspectives. Nothing written here is to be construed as representing the views of SRC.